A reliable partner

We Focus on Your Business, Not Your Credit Score.

Empower growth

We Help Fund Your Business for Profitable Growth

Direct Lending

Funding That gives you Leverage, Helps You, and Doesn't Hinder You

Easy Funding

We will provide you, your business, with fast & Easy Funding

Our services

Our focus is on delivering you the absolute best financial support, providing you financial aids through your business needs.

Looking for advice?

It is never too late to start managing your Business finances.

Now is the time to take control.

The smartest thing to do with your money

Frequently Asked Questions

A list of frequently asked questions to help you understand how it works. A list of frequently asked questions to help you.

1. How can I get a business loan?

- We Want to Know More About You and Your Small Business

Complete our short online application: it only has a few simple questions about your small business. You will learn if you prequalify for a business loan in just a few seconds! - Review Your Options With A Small Business Loan Specialist

We will explain your funding options to ensure you have the capital you need without hurting your cash flow. At this point, we will answer any questions you may have about the loan process. - Submit Basic Financial Records

Submit information about your business cash flow. Sharing your financial statements is easy and secure! This will help us personalize your business loan so that it fits all your needs. - Accept the Final Offer and Business Loan Terms

Our team is ready to present a final loan offer. You just need to review the terms and sign! - Receive Funding

You’re ready to receive the capital you need! We’ll deposit the funds directly into your bank account.

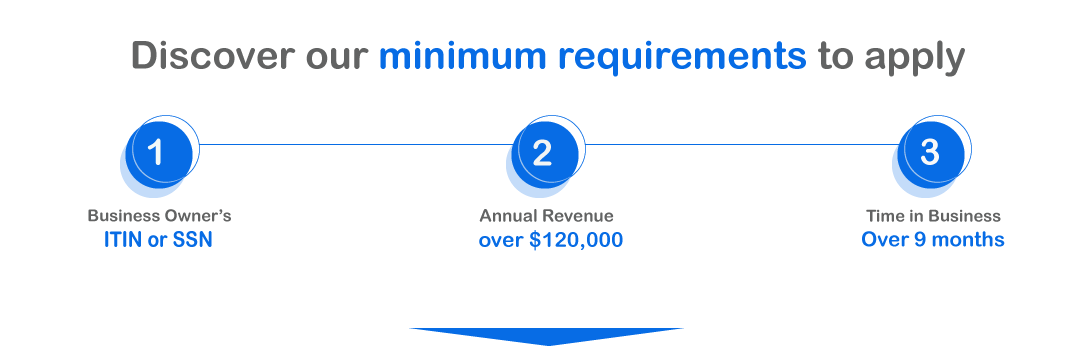

2. What are the requirements?

Do you want to apply for a business loan with Trustafi? These are the requirements you must meet:

- Your business needs to have been operating for at least 9 months

- Earn $10000 in monthly gross income (or $120,000 annually)

- Have an SSN (Social Security Number) or an ITIN (Individual Taxpayer Identification Number)

- You need to be the owner of at least 50% of the business

- Be located in the US. All states (except Puerto Rico)

- Don’t have any bankruptcies in the last 24 month.

3. What type of business loan does Trustafi Financial offer?

We offer unsecured, term loans at fixed interest rates and with flexible requirements. We’ll help you finance the needs of your company.

4. Should I apply for a business loan with TA?

Yes! We understand the ins and outs of the industry and know what you need. Our experience with business owners and contractors like you helps us create loans that will fulfill all your needs.

We don’t think of our customers like numbers. You are part of our family.

5. Can I get a business loan if I only have an ITIN?

Of course!

We understand how important funding is for all businesses; that’s why we don’t factor in your immigration status. When applying for a loan, we focus on you, your business, and your story.

At Trustafi, we approve owners with only an ITIN.

6. Can I apply for a business loan if I don’t have a credit history?

Yes, you can apply!

We don’t require you to have previous credit history nor a minimum credit score. Why? Because knowing that you are a hard-worker business owner is more important than a score. Everyone should have the same access to financing.

7. Do I need collateral to apply for a Financial loan?

With us, you don’t need to put up collateral.

We offer unsecured loans, which means we don’t ask for collateral to secure your loan. We don’t want you to risk your property, so your vehicles, equipment, and other assets are safe with us

8. What are your interest rates?

Our annual interest rates range from 12.00% to 24.75% for our business loans and 19.0% to 34.0% for our microloans.

9. Is the lending process safe?

Yes.

We know how important it is that personal information stays safe. So we use the same technology that banks use to protect sensitive information and documents.

With us, your information will always remain safe.